Offshore wind update: 3,500 jobs expected as projects enter next stage

Even as some companies backed out of development, others are confident turbines are the future.

Last week the federal government announced that two of Gippsland’s offshore wind projects are moving to the next stage of development as construction of Australia’s largest offshore wind farm edges closer.

What happened: On December 5, the federal government announced it had renewed a major project status for Star of the South’s offshore wind farm and that a second company, Blue Mackerel, had also been granted major project status.

What does major project status mean? Major project status enables significant projects to get extra support from the government in navigating regulation, coordinated approvals and assisting in development.

What and where are the two projects?

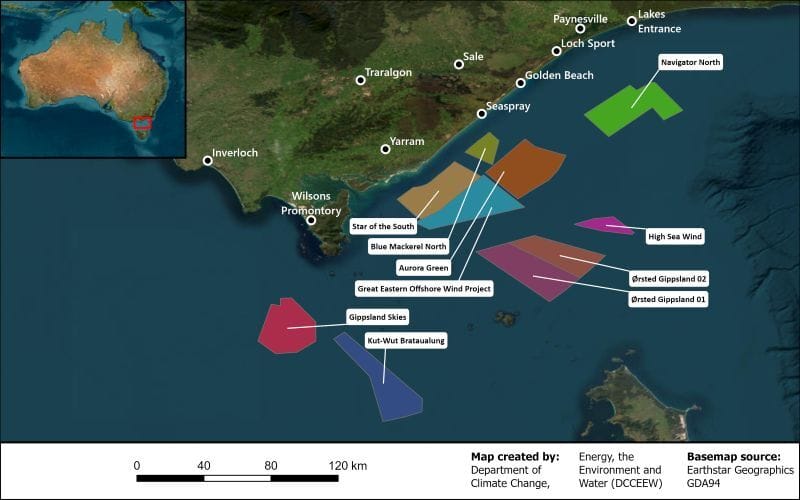

Blue Mackerel Offshore Wind Project is in the Gippsland offshore wind zone, approximately 10km from Seaspray.

The 69 wind turbines in this development will have the capacity to generate an average of 1GW of renewable energy (enough to power roughly 550,000 homes).

It’s estimated the project will create about 1,500 construction jobs and 200 ongoing jobs.

Major project status was renewed for the Star of the South Offshore Wind Farm, located off the coast of Port Albert.

The 150 wind turbines in this farm are expected to generate 2.2GW of renewable energy (enough to power roughly 1.2 million homes).

This project is expected to create about 2,000 construction jobs and 300 ongoing jobs.

Map of Gippsland’s offshore wind zone. Source: Department of Climate Change, Energy, the Environment and Water.

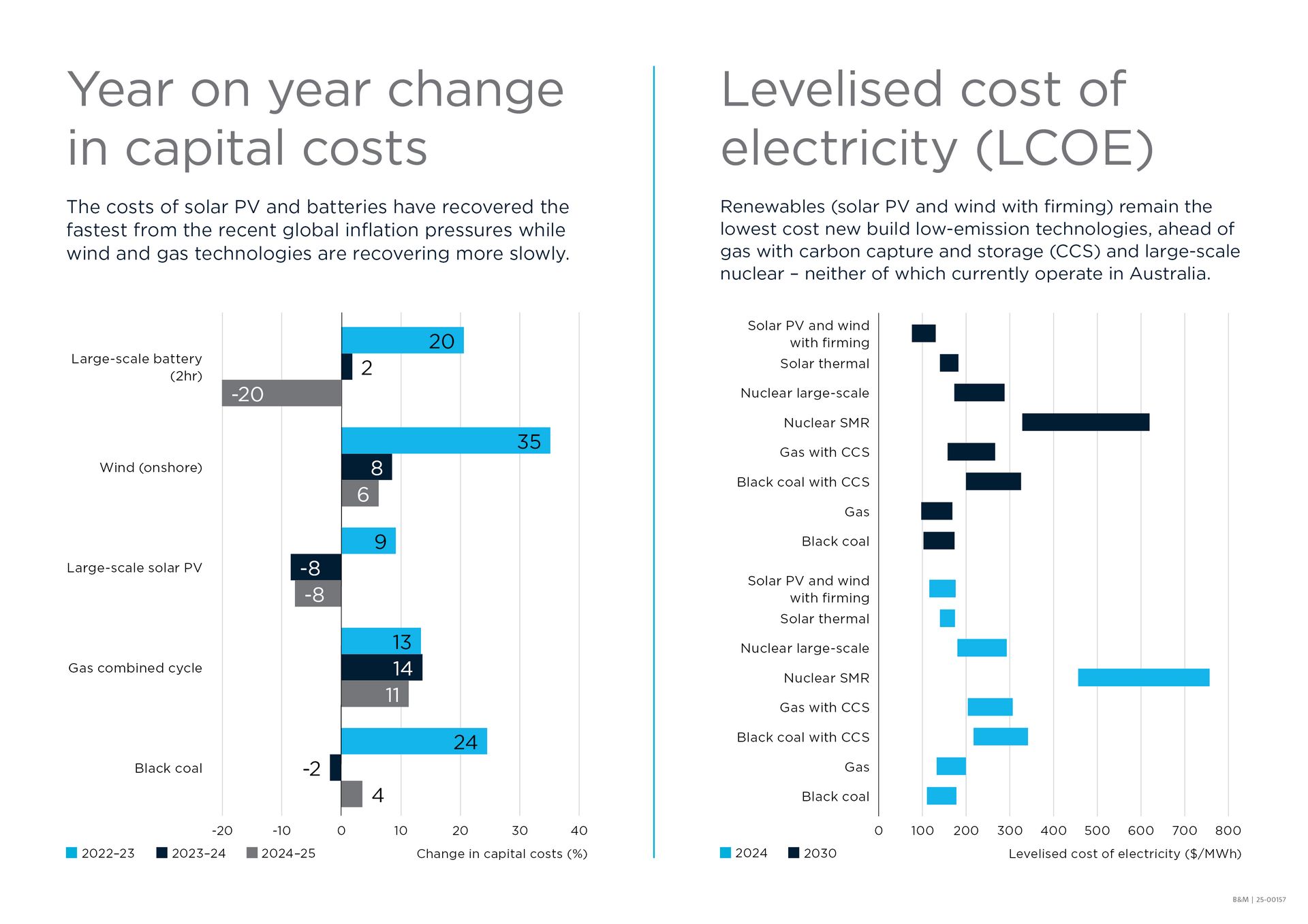

Is wind power still cheap?

While these two projects are going ahead, last week energy company AGL backed out of its offshore wind project, making it the third company out of the original 12 to do so.

The Monitor spoke to Professor Magnus Söderberg, a researcher at the Centre for Applied Energy Economics and Policy Research at Griffith University about offshore wind development in Australia.

🗣️ Söderberg said: “For the past 15 years we can see that we've had a constant decline in the cost for wind and solar, however, in 2023 and 2024, [the cost of] wind has increased slightly.”

The cost of energy generation graph from the 2024-25 GenCost report by the CSIRO and the Australian Energy Market Operator (AEMO).

Although offshore wind is still cheaper compared to other energy sources such as coal and gas, Söderberg said the growing cost of construction in Australia is a problem.

Söderberg pointed to a few main factors that are driving the cost of construction:

Interest rates - If an investor wants to borrow money for a project, it's comparatively expensive now compared to a couple of years ago when the interest rates were lower.

Cost of materials - The cost of steel, copper, fibreglass and other materials needed for wind turbines rose during the pandemic and have remained relatively high.

Cost of labour - Australia faces a shortage of workers with the skills to build and maintain wind farms, resulting in higher wages and recruitment costs.

Söderberg pointed out that these factors aren’t just impacting the wind industry but many parts of Australia’s economy.

He said the cost of offshore wind farm construction could be reduced by expanding the skilled workforce in Australia and manufacturing some of the larger components of the turbines here instead of paying expensive transport costs.

Even though there is some headwind Söderberg said: “I think a lot of investors are expecting the cost of wind construction to keep falling.”